Sharing or Gig Economy Or Collaborative Economy/Consumption As A Threat To Traditional Successful Business Models

· Secret of the sharing economy is its capital-lite, technology-driven ability to unlock value in what was previously neglected or underutilised goods and services.

· This business model is based on high tech gadgetry and sophisticated programming codes that feed smart phones and websites. It is reinventing how supply can meet demand, and shifting mindsets about private possessions and ways of consuming. It means the behaviours that were once confined to the online world on your computer are now spilling over into the real world via mobiles like smart phones. Australia has a smart phone penetration of around 64 % (2013).

· It is based on an old notion of rural/village community sharing or bartering of capital stock and taken it to a global marketplace; with the latest technology (including connectivity) making it seamless and allowing micro-businesses to merge. For example, Goget was conceived after consideration of the wide gap between having a car and not having one, ie there was no service in the middle

"...there are still lots of areas in the economy where there is a polar choice - you either fully have a good or you don't have any of it..."

Bruce Jeffreys as quoted by Jacob Greber et al, 2014

· There is a greater integration between online networks and off-line life; with people having enriching experiences, eg meeting interesting people whom they would not normally meet. On the other hand, there are regulatory, eg safety issues, etc and tax questions that need policymakers' attention; regulators are struggling to create rules around something that never existed before. Most sharing economy services are emerging in a policy and regulatory vacuum. As more activity shifts to the collaborative economy with more people "earning a bit on the side", the taxman will start to pay more attention to it.

· It has been described (Warwick McKibbon, 2014) as a definite productivity driver and will create more value in the broader economy than it destroys. At the same time, there will be distribution aspects, ie winners and losers but overall everyone will be better off.

"...Look at all the capital stock - people have their cars sitting in garages something like 80% of the time. Think about the stock of houses and schools. Imagining if schools operated beyond 9 to 5 and had more after-school activities..."

Warwick McKibbon as quoted by Jacob Greber et al, 2014

"...it will add an awful lot of competition...... by expanding the range of things society can consume without requiring what economists call additional "inputs", the results should be a net boost of GDP..."

John Freebairn, as quoted by Jacob Greber et al, 2014

"...This is having a profound impact on many consumers, who now realise that they need only pay for what they use rather than sink money into assets that are only occasionally utilised..."

Peter Williams as quoted by Jacob Greber et al, 2014

· Total size of the new economy is still small but growing and has the potential to be big as the mining, retailing and construction sectors of the Australian economy. For example, over a 12 month period, Airbnb had 30,000 stays in Sydney, contributing US$ 214 million to the local economy and supporting 16,000 jobs

· It is becoming a threat to the traditional business models, ie creative destruction. It has the potential to shake up lazy industries and organisations. For example,

"...A budding entrepreneur travels from Brisbane to Melbourne for a meeting. Using the iPhone she hires a chauffeured limo via Uber to get to the airport and, once at Tullamarine airport, hires a GoGet car. Minutes before her meeting begins in the CBD a venue is booked on LiquidSpace, a company which rents out empty offices and conference rooms with people by the hour. At the meeting a new business venture takes shape, but instead of seeking a bank loan, the group request capital from wealthy investors on crowd-funding site VentureCrowd.

Keen to eat dinner in Melbourne's latest hip laneway restaurant but unwilling to wait for a table at the no reservations venue, she briefly employs someone to wait in the queue with Airtasker, leaving time to rent a Gucci python slouch handbag from designer rental service LoveMe and LeaveMe. As the day closes, she sleeps the night someone else's city apartment; the owner is away for the week and has listed their place for short-term rental on Airbnb.

Such is life in the shared economy..."

Jacob Greber et al, 2014

· The 3 components of sharing

i) platforms for websites and smart phone apps that create goods and services

ii) the entrepreneurs or individuals that supply spare goods and services

iii) consumers

This is sometimes called peer-to-peer networks, ie seek to re-purpose owned assets as a rental service, etc.

· Just as in the village community concept of sharing/bartering, trust and credibility are important commodities in this new economy to survive and thrive. For example,

"...GoGet is a shared fleet of cars that members can use at a whim. You pay your membership with a $500 deposit, hop online to book a car for a few hours, users swipe their card to unlock the car and drive away. When you're done, you park it and leave the keys behind..."

Nassim Khadem, 2014

Trust and credibility are part of a private brand, ie your reputation that you will do the right thing and are transparent in your activities. This goes beyond the concept of the traditional consumer behaviour. Increasingly platforms are relying on sophisticated systems to measure reliability and trustworthiness of users; this includes reviews of your performance from other users. The more reputational capital you earn, the more you can participate in the sharing economy. Everything you do on the social media/Internet connections is affecting your reputational capital I think ebay was an early leader in developing this feature of reputational capital.

Most of the shared economy firms like Airbnb, Uber, etc are P2P services, ie people to people. This involves transactions between willing sellers and buyers. Other examples include

- Kiva.org (allows people to make micro-loans, like $ 25, for charity purposes; in one week alone 50+ k. lenders made loans worth US $ 3 million; the website advertises the hundred percent repayment rate

- TaskRabbit (allows people to post requests for the performance of small miscellaneous tasks, like repairing a broken fence, etc to a community of service providers; most tasks are worth less than $100; they have 20+ k. background-checked regular supply services.

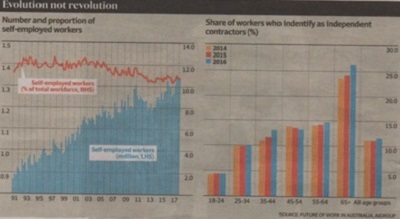

Despite the rise of the gig/platform/shared economy, traditional employment still dominates. With the gig economy

"...we were told the workforce would be transformed into a mass of freelancers, agile small firms would capitalise on this shift - superseding large companies - and governments would have to deal with diminishing income tax returns and superannuation contributions..."

David Marin-Guzman 2018

In the 5 years since the likes of Uber and Airtasker popularised the concept of the gig economy

"...Analysing ABS stats......found self-employment is falling, full-time employment is increasing and casualisation has been pretty much stable for the past decade..."

David Marin-Guzmen 2018

Traditional employment is still the preferred model for work and it offers advantages to businesses including the best means of controlling, motivating and influencing workers.

The likes of Uber are using technology and algorithms to develop new frontiers of control like price surging flood peak periods and customer star ratings as performance management, etc. These platform technology companies are introducing new levers to influence behaviour while maintaining an arm's length relationship with their workforce. In 2018 many traditional organisations think that this approach is too experimental and involves too much risk and uncertainty.

In Australia statistics show

"...Independent contractors, which is how most gig workers would be classified, has not changed in proportion of the workforce since 2012. While there are more individuals who classify themselves as contractors, they still account for less than 11% of the workers.......While casual employment increased in the 1980s and 90s, it has hovered around 25% of the workforce for the past decade......As for tax revenue......the gig economy has yet to have an impact. The government had been concerned that shift to a peer-to-peer economy, where more workers would be self-employed, threatened reductions in income tax revenue and an expansion of the black economy. But, as of 2017 at any rate, this had not occurred..."

David Marin-Guzmen 2018

Neither has there been a decline in importance of large companies

"...businesses with 200 or more employees account for about 24% of private sector employees in 2014-15, similar to 2009-10..."

David Marin-Guzmen 2018

(source: David Marin-Guzmen, 2018)