A Disruptive Business Model Is A Valuable Corporate Asset

Introduction

Disruption refers to innovations that changed the accepted way of doing things:

"...in almost every sector there are disrupters that are embracing new technologies and are not encumbered by old technologies..."

Cathie Wood as quoted by Duncan Hughes, 2017

For example, smart phones changed mobile phones by adding a musical player, computer, book, diary, Wi-Fi dongle, GPS unit and camera while changing size from a brick to an envelope

"...They also encouraged third-party applications and fostered a new array of digital intermediaries requiring mobile access - such as taxi services like Uber, food delivery companies like Deliveroo and repositories such as photo sharing platform Flickr..."

Duncan Hughes, 2017

The changes can be

- evolutionary, ie smarter, faster and more efficient, eg digitalising every step in property buying to reduce time needed to approve a loan from 22 days to 22 minutes (Tic:Toc Home Loans)

or

- revolutionary, ie a different way of doing something, eg Amazon in the retail sector.

Many innovations have to wait for right amount of computing power, connectivity, mobility, digital technologies, data storage capacity, etc to handle them.

Disruptive technologies usually serve the customer better by providing better experience, greater convenience and at lower cost.

"...the average age of a company listed on the Standard and Poor's 500 fell from almost 33 years in 1965 to 20 years in 1990. It's forecast to shrink to 14 years by 2026......during the past 20 years pure Internet companies have grown to nearly 10% of the index with a market cap of around $ 1.7 trillion..."

Ark Invest as quoted by Duncan Hughes, 2017

Major technological changes at a glance

Australian companies in the disruptive phase

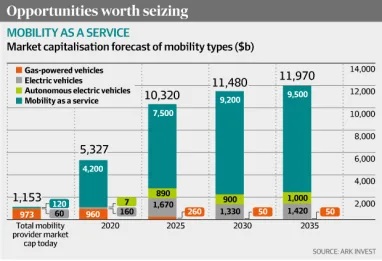

Mobility as a service

Block chain

Robots

When people talk about disruption, it is assumed that is linked with technology. However, disruption can come from many areas:

- weather (hurricanes, bushfires, floods, droughts, etc),

- financial (interest rates, growth rate, wages, productivity, etc)

- government uncertainty (policies, rules and regulations, etc)

- infrastructure (energy, resources, etc),

- socio-demographic (differences between generational, ethnic groups, etc), etc

As disruption is continuous, it impacts industries at different times.

The basis for disruption is

"...As growth of the incumbent company stalls and they struggle to meet modern customers demands with outdated technology, they missed earnings forecasts and are then driven to do exactly the opposite of what they need to do to survive. Instead of focusing on adapting to survive in the medium term, they focus too much on the short term, driven by investors' expectations and management incentives..."

James Eyers 2020

For example, the Internet is disrupting industries like banking, media, ITC, etc

Disruptive business models as used by the likes of Amazon (books), PayPal (payment), Uber (taxi), Airbnb (accommodation), etc are moving into industries in which there is

- charging of excessive fees and/or

- making of excessive profits and/or

- poor customer service/high customer dissatisfaction and/or

- under-utilised assets and/or

- using out of date technology.

Some examples of industries under threat for the above reasons are:

- the data intelligence/analysts industry, like Thomas Reuters, Bloomberg, Gartner, etc, that have been in the industry for decades and built a US$ 10+ b. market. They have had little impetus to change owing to their market dominance combined with their public shareholders' expectations from this cash cow, ie short-term profit and the dividends. Yet almost all customers are dissatisfied. This has provided an opportunity for a disruptor, like FiscalNote (started in 2013 and worth US$ 18 m. in late 2015), to come in to differentiate itself by speed and breadth of information delivered, its superior design platform and customer service disrupt the research divisions at analyst companies. These disrupters are using their ability to predict what customers will want. (Rachel Botsman, 2015b)

- the taxi industry. Uber, a technology-based disruptor that provides a ride-sharing service, is doing what years of inquiries, complaints reforms, etc have not been able to do to a monopolistic industry, ie taxi. Customers in the taxi industry are fed up with delays, bad drivers, excessive fees and poor service. Uber's popularity and increasing protest of established taxi licence holders about Uber are putting pressure on regulators and state transport authorities to find a solution. In addition to Uber, booking and payment apps, like goCatch and ingogo, are providing alternate payment systems to the likes of Cabcharge. Cabcharge has dominated the Australian taxi industry since 1976 and charges a flat 10% fee on every fare paid via its eftpos terminals (in 2015 this was dropped to 5% in some States).

Uber adopts combative tactics. It targets "poorly serviced" cities by giving drivers iPhones, with the Uber app installed. The legal Uber black posh-car service enters the market first; once established, Uber X is introduced, (Jessica Sier, 2016b)

These models use the latest technology to generate an asset-light approach, with low overheads.

"...A disruptive business model that can generate attractive profits at a discount price required to win business at the low end is an extraordinarily valuable growth asset. When its executives carry the business model upmarket to make high-performance products that sell at high price points, much of the increment in pricing falls to the bottom line - and it continues to fall there as long as the disruptor can keep moving up, competing at the margin against the higher-costs disruptee. When a company tries to take a high-cost business model down market to sell products at lower price points, almost none of incremental revenue will fulfill its bottom line. It gets......into overheads. This is why......established burdens that have to capture the growth created by disruption need to do so within an autonomous business with a cost structure that offers as much headroom as possible for subsequent profitable migration upmarket......disruption does not guarantee success, but it sure helps......following a strategy of disruption increases the odds of creating a successful growth business from 6 percent to 37 percent......is also clear what executives who seek to create new growth business should do: target products and markets that the established companies are motivated to ignore or run away from. Many of the most profitable growth trajectories in history have been initiated by disruptive innovations..."

Clayton Christensen et al, 2003

Over the centuries, many examples of industries dominated by what seemed stable organisations go out of business, thanks to the action of competitors or disrupters.

Manufacturing, media, energy, financial services, etc have experienced 'great dying' (Niall Ferguson as quoted by Ian D Gow et al, 2018). An example, horse and buggy to automobile, ie

"...in 1900 there were 7,632 wagon and carriage manufacturers in the United States. Adopting Henry Ford's methods, the industry would soon be reduced to the Big Three..."

Matthew Crawford as quoted by Ian D Gow et al, 2018

In industries like banking and accounting, several large players dominate. They could be easily disrupted by new technology in the banking industry. Non-technical disruptions could be regulatory (especially as a result of bad behaviour), customer defection (a more effective alternative), etc.

A few large firms dominating the accountancy industry are finding

"....Both advisory and audit services are being disrupted, commoditised, digitalised and offshored......their franchise structure and partnership model are barriers to large-scale investment in the necessary innovations......the leverage model and partner track depends on growth...... is unsustainable. In the face of technological disruptions, the firms are suffering an exodus of ideas and talent. They imagine they can control digital technologies and 'disrupt themselves. They cannot..."

Ian D Gow et al, 2018

"...faced with a growing riskiness of modern accounting, and the growing litigiousness of investors and clients......(they) have invested massively in risk management..."

Ian D Gow et al, 2018

To handle this risk management, they have created and staffed large risk departments which have built systems upon systems. Yet the largest risks facing the industry like market disruption and service obsolescence cannot be solved by compliance.

These large firms have an inherent tension between the rush for size and the need to maintain human-scale operations. Other issues include

- standardisation or differentiation

- private interests or public interests

- conservativism or "pushing the margins"

- conformity versus diversity

China is also posing a threat to their model with a different culture and political system.